Case Study: Kiwibank ATMs

As part of their future self service strategy, Kiwibank’s Customer Experience team wished to evolve their network of ATMs and the service they provided.

I shaped a research approach to provide insights the team required to be informed and confident about the role their cash machines, and cash itself played in the context of their customer’s lives.

My approach was qualitative and ethnographic – a ‘deep dive’ into the attitudes and behaviours of a carefully selected sample of Kiwibank’s customers.

Stakeholder Interviews

We started looking out from the inside understanding how ATMs fit into the service ecosystem and organisation by interviewing Kiwibank’s business, operations, marketing, product, call centre and data analytics teams.

Define objectives

Learnings from staff interviews helped steer the research brief, prioritising objectives and the types of insights which would be most useful for short and medium term planning.

Building a sample

We worked with Kiwibank to identify a representative spectrum of customer types across generations, demographics, usage patterns and locations in urban and rural North and South Island.

Observation in context

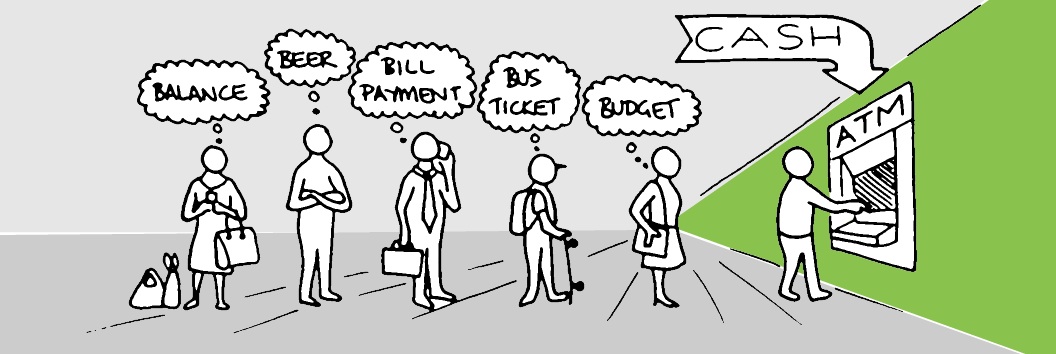

There’s no better way to get a feel for customer behaviour than observation in context. We watched (from a distance) typical usage of ATMs in the street, supermarket, branch etc. noting behavioural patterns and usage types in these locations.

This short contextual primer provided starting points for exploring the needs which drive these behaviours, in person with our sample customers.

Deep-dive interviews

We conducted in-home interviews, usually at the kitchen table. A relaxed and natural conversation covered ground from the purely practical, like; time of day, frequency, amount, location etc., through to the personal and emotional, sometimes revealing subconscious habits and behaviours.

Analysis and synthesis

From interview notes and video recordings we analysed our data for patterns, themes, then insights relevant to the objectives of the study. Selected quotes from the sessions revealed the voice of the customers behind the insights.

Video highlights

From hours of video footage we edited documentary style videos to support key themes of the findings. This candid, natural footage was highly engaging and built instant empathy for customers amongst the stakeholders.

Outcomes

Delving beyond the user interface and features revealed insights at a human as well as functional level.

Our video highlights engaged stakeholders, provided contextual reality, built empathy for the customer and consensus among stakeholders around customer needs.

Insights applied

Our findings:

- Painted a clear picture of how ATMs and cash are woven into the lives of different customer types.

- Helped Kiwibank prioritise their ATM channel around what really matters to their customers.

- Highlighted which customer types benefit most from which ATM services.

- Revealed opportunities for new tools to inform and empower customers.

- Identified opportunities to meet specific customer needs through multiple channels.

- Demonstrated how ATM services could be improved to better meet customer need.

Personally…

At a personal level this project was utterly intriguing. Customers revealed quirky habits, fascinating behaviours and individual strategies to deal with cash.

Sometimes a seemingly mundane topic will reveal rich and emotive aspects of people’s lives. This was one of those projects.

You’ve made it this far, See the rest of the iceberg with these other fascinating projects.